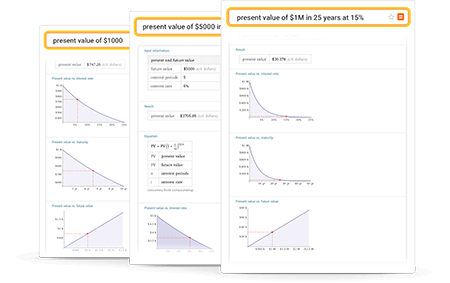

Wolfram|Alpha can quickly and easily compute the present value of money, as well as the amount you would need to invest in order to achieve a desired financial goal in the future. Plots are automatically generated to help you visualize the effect that different interest rates, interest periods or future values could have on your result.

Online Present Value Calculator

Compute the net present value of money with Wolfram|Alpha

Easy computation of savings and investments

Learn more about:

Tips for entering queries

Enter your queries using plain English. Your input can include complete details about future values, interest rates and interest periods, or you can add, remove and modify values and parameters using a simple form interface.

Present value basics

The present value formula is used to determine what amount of money you would need to invest today in order to have a certain amount in the future, allowing for different interest rates and periods.

This formula is commonly used in corporate finance and banking, but is equally useful in personal or household financial calculations. Given a projected or desired future value of money, an interest rate and a number of interest periods, the present value calculator can compute the present value of that money, or the amount you would need to save or invest in your chosen financial instrument in order to achieve that future value. The effects of compound interest—with compounding periods ranging from daily to annually—may also be included in the formula. Plots are automatically generated to show at a glance how present values could be affected by changes in interest rate, interest period or desired future value.